Budgeting is important because it helps you stay in control of your money instead of feeling stressed out about it. When you know exactly where your money is going, you can avoid spending too much and save up for things you really care about. A budget also helps you handle surprises—like an unexpected bill—without worrying. Best of all, it gives you peace of mind and helps you reach your goals, one dollar at a time.

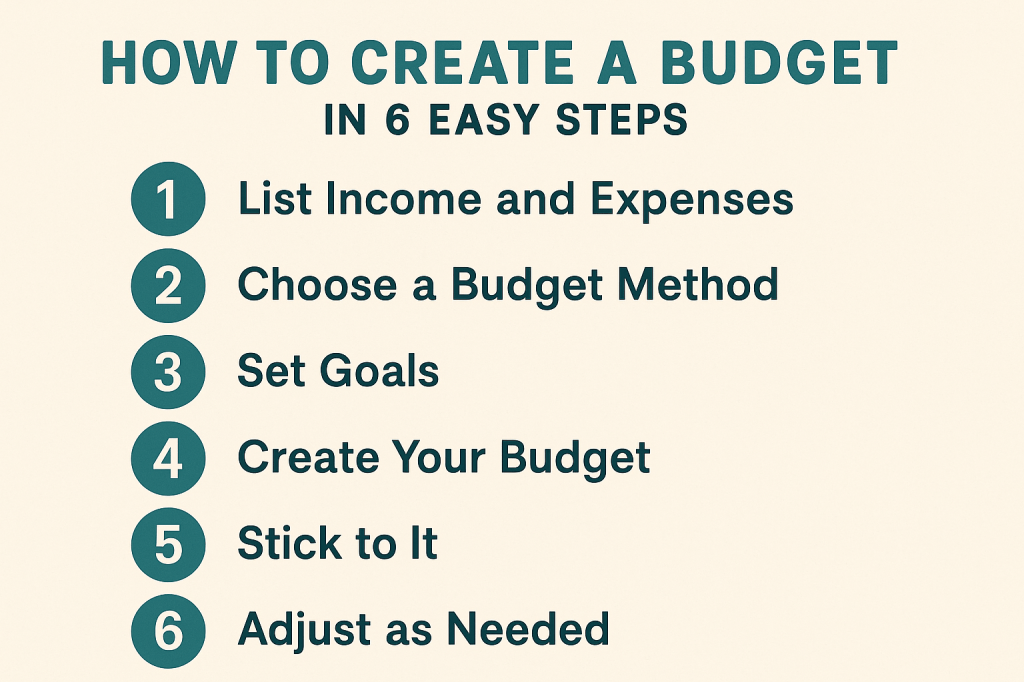

Step 1: List Income and Expenses

Figure out how much you make each month (after taxes) and track where your money goes. List your income (paychecks, side gigs) and your expenses (rent, bills, groceries, fun spending). Use whatever method feels easiest—apps, spreadsheets, or pen and paper.

Step 2: Choose a Budget Method

Pick a method that fits your lifestyle:

- Pay Yourself First: Save first, spend the rest.

- 50/30/20 Rule: 50% needs, 30% wants, 20% savings.

- Zero-Based Budget: Every dollar has a job.

- Envelope Method: Use cash envelopes to control spending.

Step 3: Set Goals

Define your short-term, medium-term, and long-term goals. Make them specific and realistic to keep your motivation strong.

Step 4: Create Your Budget

Subtract your expenses from your income and assign money to each category. Leave a little wiggle room for unexpected costs. Remember—there’s no perfect template! Adjust it to your needs.

Step 5: Stick to It

Check in weekly or monthly to stay on track. Use automatic transfers and alerts to make it easier. Focus on progress, not perfection.

Step 6: Adjust as Needed

Life changes—so will your budget! Update it as needed to stay on top of your finances and keep moving toward your goals.