Automating your savings can simplify the process of building financial security. Here’s a review of three highly rated apps—Qapital, Oportun, and Acorns—that help users save money effortlessly.

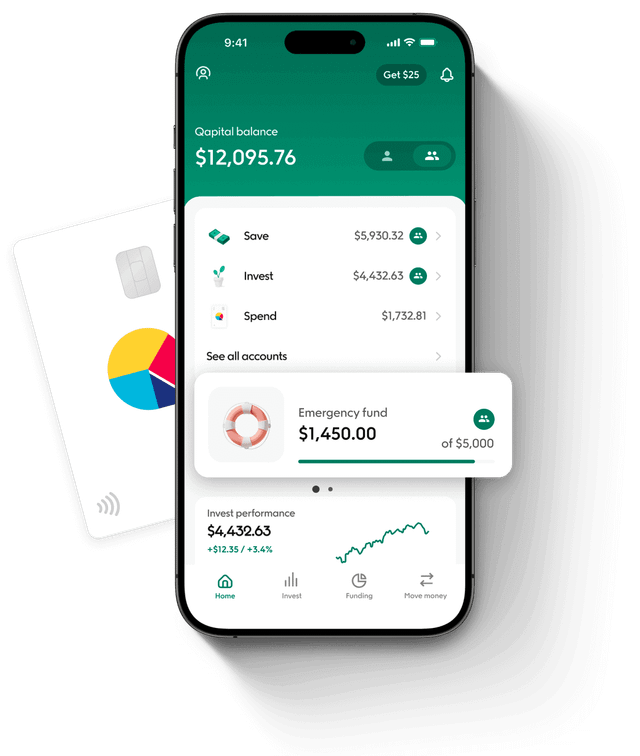

1. Qapital

App Store Rating: 4.8/5

Google Play Rating: 4.3/5 (21.6K reviews)

Qapital allows users to set personalized rules that trigger automatic savings. For example, you can round up purchases to the nearest dollar or save a set amount when you complete specific actions.

Pros:

- Customizable savings rules

- No minimum balance requirement

- Provides numerous tools

- No investment management fees

Cons:

- Low interest rates on savings

- Monthly fees ($3, $6, or $12)

- Limited checking account features

- Customer support limited to email or in-app contact

User Review:

- “I have been a long time user of Qapital… I like it because I’m a 1099 worker and have to pay my own taxes quarterly. So I have Qapital pull XX% from what my clients pay me each month – and set it aside for taxes. Convenient.”

Visit Qapital.

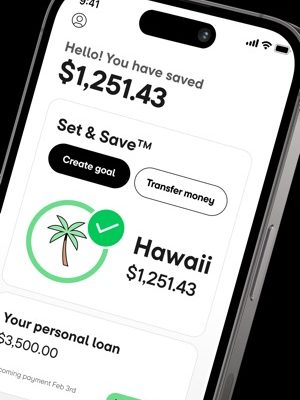

2. Oportun

App Store Rating: 4.7/5

Google Play Rating: 4.0/5 (48K reviews)

Oportun analyzes your spending habits and automatically transfers small amounts to your savings when it deems appropriate. This approach helps users save without manual intervention.

Pros:

- 30-day free trial

- Oportun personal loan and credit card customers get 1 year free membership

- Savings and budgeting tools to help you automatically save

- Set personalized savings goals

Cons:

- $5 monthly service fee

- Cannot earn interest on funds deposited into savings account

- Only investment option is ETFs

User Reviews:

- “I absolutely love this app. I would never been able to save money without it. I have never been good at saving money myself but with the app taking out little bits of money I have been able to save a good amount of money.”

- “Edit: I love this app… When it works. My account is connected but after just a couple transfers it stops working. I’ve done my due diligence to ensure Plaid and my bank are connected and nothing is stopping the transfers.”

Visit Oportun.

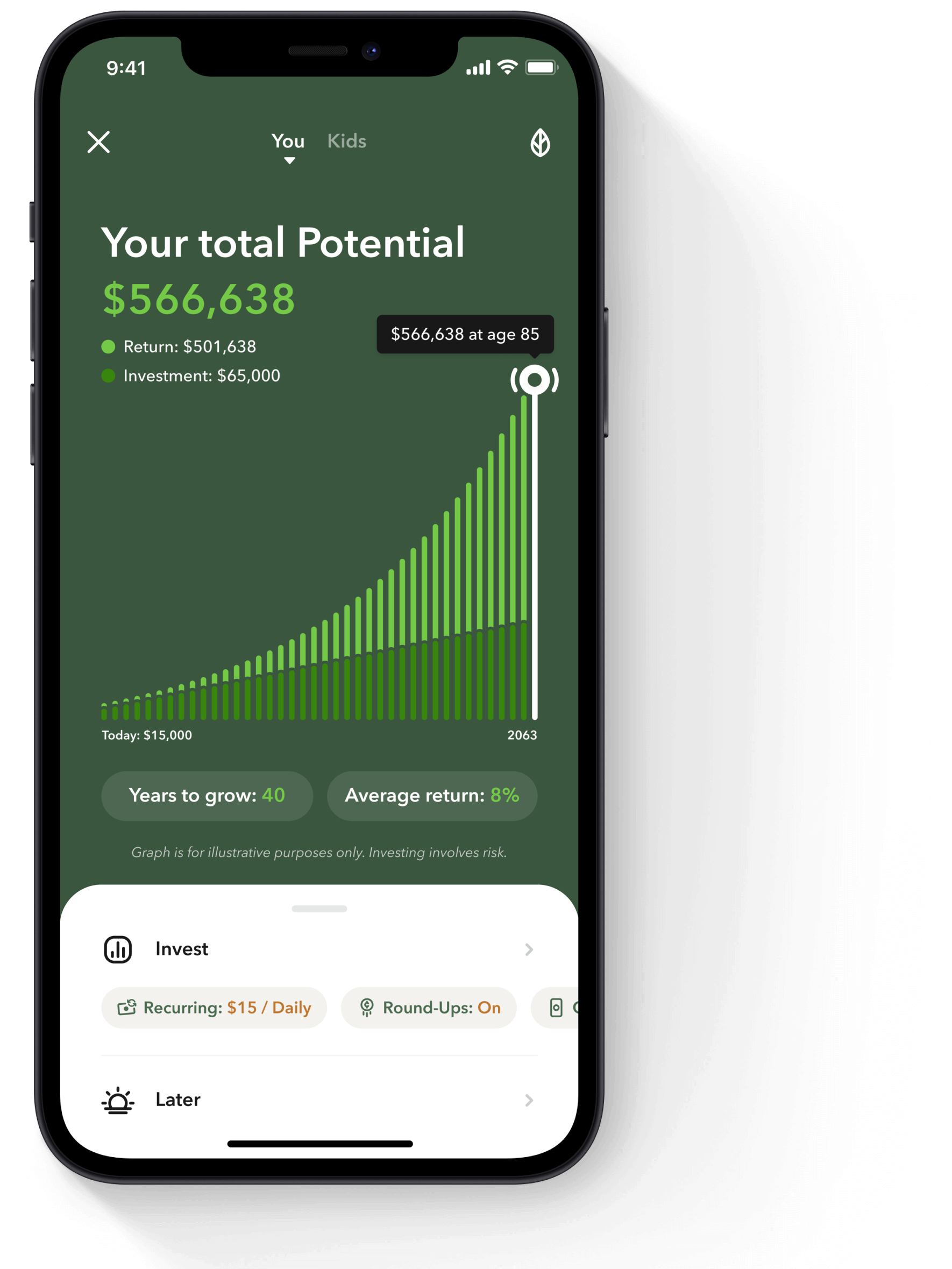

3. Acorns

App Store Rating: 4.7/5

Google Play Rating: 4.7/5 (345K reviews)

Acorns rounds up your everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio.This micro-investing strategy allows you to grow your savings over time with minimal effort.

Pros:

- Automatically invests spare change

- Cash back at select retailers

- Educational content available

- No account minimum ($5 required to start investing)

Cons:

- Monthly fees can be significant for small balances

- $35 per ETF to transfer funds to another broker

- No tax-loss harvesting

User Reviews:

- “Great App with Minor Registration Hiccup: The Acorns app is user-friendly and perfect for saving and investing effortlessly. I love the automated investing and round-ups feature that grows my savings over time.”

- “Acorns helps you save, invest, and grow for your future. Our automated saving, investing, and spending tools help you grow your money and your financial wellness.”

Visit Acorns.

Sage Summary

Each app offers unique features:

- Qapital: Ideal for those who enjoy setting specific savings rules and goals.

- Oportun: Best for users who prefer a hands-off approach, letting the app decide when and how much to save.

- Acorns: Suitable for individuals interested in micro-investing, allowing their spare change to grow over time.

Consider your financial habits and goals to choose the app that aligns best with your needs.