Category: Managing Debt

-

Mastering Student Loans: A Comprehensive Guide

Student loans can be a headache, but knowing your options helps. You’ve got federal loans, which are usually friendlier with lower rates and forgiveness, and private ones with stricter terms. Keep track of your balances, consider repayment strategies like avalanche or snowball, and don’t forget to celebrate your progress!

-

The One Big Beautiful Bill Explained: What Gen Z Needs to Know—And What to Do About It

In July 2025, Congress enacted the One Big Beautiful Bill (OBBBA), a comprehensive legislation impacting taxes, healthcare, and energy policy, primarily benefiting higher earners while cutting social programs. Generation Z will feel its effects on income, student loans, and climate policy, necessitating proactive adaptation to navigate these changes successfully.

-

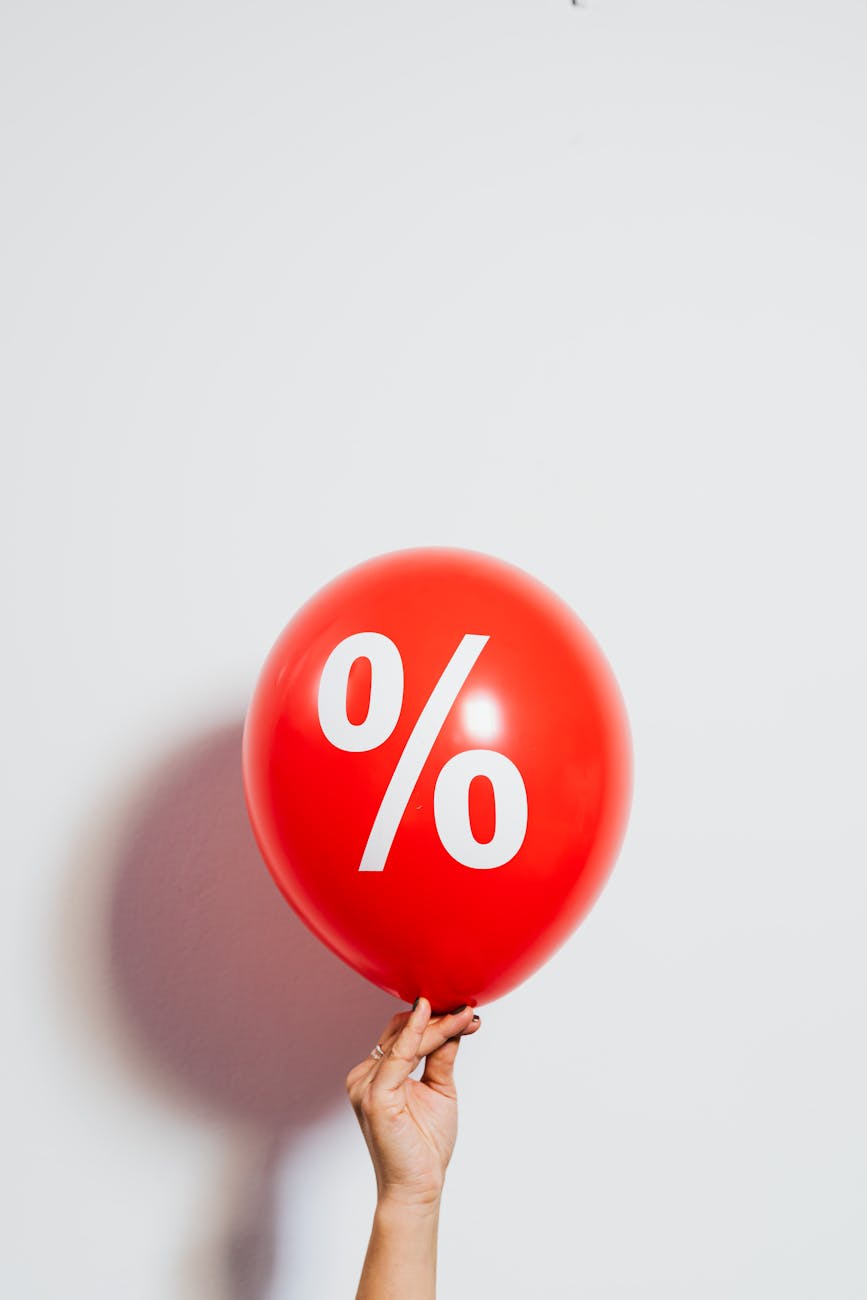

5 Essential Strategies for Managing High Interest Rates

Rising interest rates significantly impact Gen Z’s finances, affecting savings, loans, and daily expenses. With credit card rates exceeding 20%, it’s crucial to pay off high-interest debt, open high-yield savings accounts, reconsider new loans, remain strategic with investments, and renegotiate budgets. Adaptability is key to financial success in changing market conditions.

-

Top 10 Financial Tips from Reddit for Your Younger Self

If you could time travel, Redditors suggest you’d want to remind your younger self to start investing early, live below your means, manage debt wisely, and educate yourself about personal finance. Building an emergency fund, budgeting, and avoiding impulsive spending are other key tips for financial success and stability.

-

What is Interest and How to Manage It: In Simple Terms

Interest is a word you probably hear a lot when it comes to money. But what does it really mean, and how can you make sure it doesn’t cost you more than it should? Let’s break it down in simple terms. What is Interest? Interest is the extra money you pay when you borrow money.…

-

A Simple Plan for How to Spend Each Paycheck: Balancing Basic Needs, Debt, Emergencies, Investments, and Wants

Do you ever feel like your money is gone before you even know what happened? Many people struggle with managing their money. But having a simple plan can help you take control and feel more confident about your money. In this post, we’ll walk through a step-by-step plan to make the most of each paycheck.…

-

Buying a Home: True Cost of Ownership

The American dream and buying a home are often synonymous in the minds of millennials and generation Z. Buying a home is a huge milestone achievement. If you haven’t checked this milestone off, do not panic. Approximately only 25% of Gen Z adults owned homes in 2024, a figure that has remained relatively flat since…

-

Debt Snowball Method: A Simple and Effective Way to Pay Down Student Debt

Student loan debt is a big concern for many people in the U.S. As of 2025, the average federal student loan balance is approximately $38,883, and the total federal student loan debt in the United States is $1.61 trillion. Student loans can feel overwhelming, but there’s an easy way to start paying them down faster. It’s…

-

A Simple Guide on Credit Scores and How to Make Yours Better

A credit score is a three-digit number that shows how responsible you are with money, affecting loans and interest rates. It ranges from 300 to 850, with higher scores being better. To boost your score, pay bills on time, lower credit card balances, and avoid opening too many accounts at once.

-

Understanding Debt: What It Is and How to Pay It Down

What is Debt? Debt happens when you use someone else’s money to buy things, like using a credit card or taking out a loan. You have to pay back the amount you borrowed plus extra money called interest. If you don’t pay it back on time, it can cost you even more. Why Paying Down…