Category: Saving

-

Smart 10 Money Moves to Make Before You Turn 30

Your 20s are the perfect time to set a strong financial foundation. Learn 10 smart money moves to make before 30 to save more, invest wisely, and build long-term financial security.

-

Common Personal Finance Myths Redditors Say Are Sabotaging Your Savings Goals

A lot of advice about money seems smart at first, especially when it comes from friends or social media. But some of those personal finance myths young adults believe are actually holding you back. According to a LendingTree survey, 96% of Americans believe at least one money myth, and 27% of Gen Z picked up those myths from social media…

-

5 Everyday Spending Habits That Are Secretly Costing You Hundreds

Daily spending habits may seem insignificant, yet they can accumulate to hundreds or thousands annually. Common culprits include daily coffee runs, subscription overload, impulse shopping, ignoring discounts, and excessive use of ride-sharing services. By being intentional and making minor adjustments, it’s possible to save significant amounts while still enjoying life’s pleasures.

-

Simple Guide to Start Your Emergency Savings Today

Many young adults lack emergency savings, with 62% of Gen Z having none. To build an emergency fund, begin with $500 to $1,000, set achievable savings goals, and automate transfers to a dedicated account. Small budgeting changes and side gigs can accelerate savings. Consistency is crucial; start small and adjust as needed.

-

How to Save for Retirement in Your 20s: A Step-by-Step Guide for Young Adults

Saving for retirement in your 20s is crucial for building a secure future. Start early to harness the power of compound interest, set clear goals, and choose appropriate retirement accounts like 401(k)s or IRAs. Automate savings, invest wisely, and continuously educate yourself about personal finance to maximize growth and avoid penalties.

-

The 5 Most Popular and Profitable Side Hustles in 2025

Gen Z is all about side hustles, with 34% jumping in to earn extra cash. Freelancing, reselling vintage goods, and creating digital products are popular. Gig jobs offer flexible income too. Choosing the right side hustle based on skills and commitment can lead to financial independence over time.

-

10 Reasons BNPL Services Might Hurt Your Finances

Buy Now, Pay Later (BNPL) services offer convenience but pose significant financial risks. They encourage impulse spending, create a false sense of affordability, and may lead to debt spirals. With hidden fees, limited credit benefits, and no consumer protections, users must manage BNPL responsibly to avoid financial pitfalls.

-

Personal Finance 101 for Gen Z: How to Understand Money and Grow Your Financial IQ

Gen Z is increasingly aware of the importance of financial literacy, with over 70% wishing they had learned it in school. Understanding budgeting, credit scores, compound interest, and inflation can empower them to make smarter financial decisions. Small, incremental actions can lead to significant financial confidence and stability over time.

-

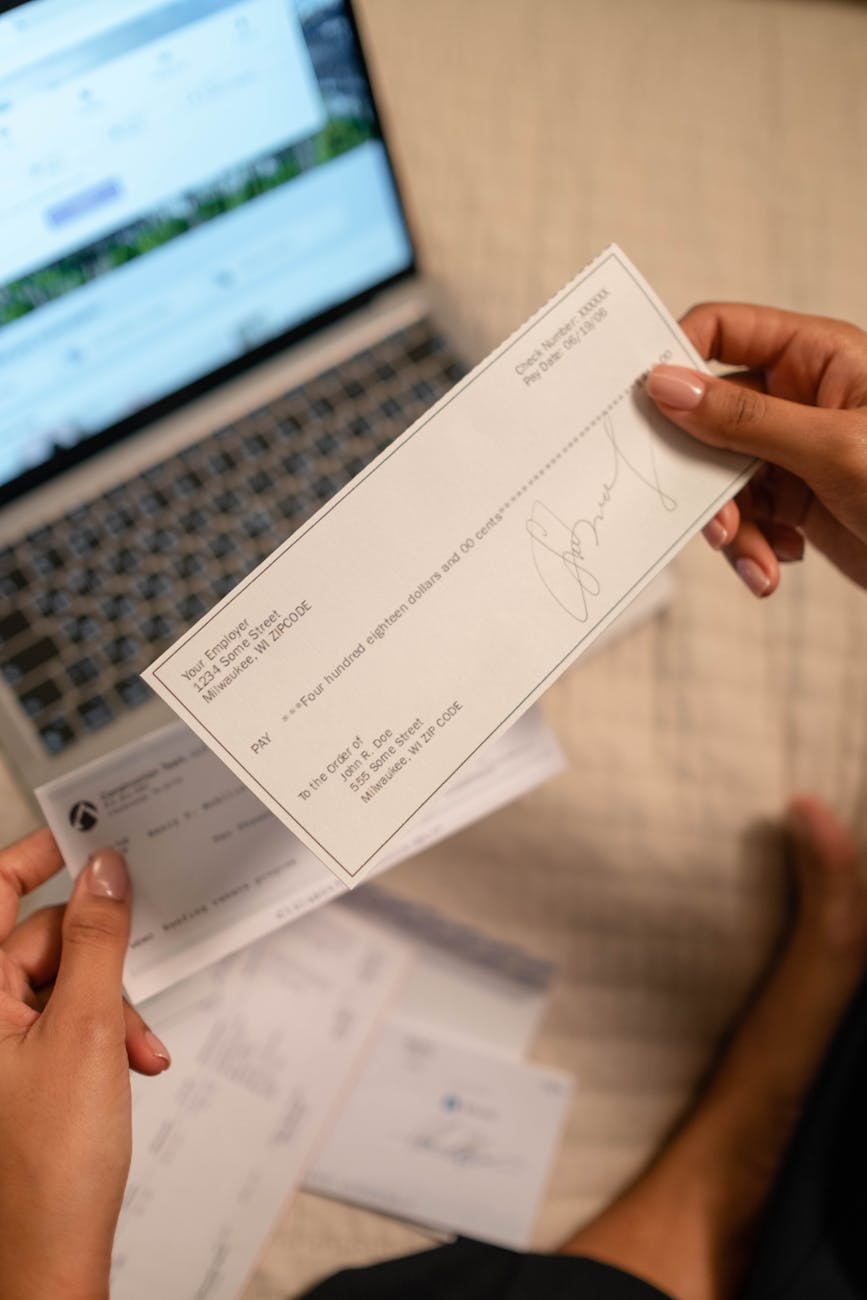

What Exactly Should I Do First When I Get My First Paycheck?

Receiving your first paycheck is an exciting milestone, but knowing how to manage it can be daunting. Begin by understanding your net pay and creating a budget using the 50/30/20 rule. Build an emergency fund, pay off high-interest debt, save for long-term goals, and remember to budget for enjoyment. Taking these steps fosters financial confidence.