Tag: Simple Guide

-

How to Save for Retirement in Your 20s: A Step-by-Step Guide for Young Adults

Saving for retirement in your 20s is crucial for building a secure future. Start early to harness the power of compound interest, set clear goals, and choose appropriate retirement accounts like 401(k)s or IRAs. Automate savings, invest wisely, and continuously educate yourself about personal finance to maximize growth and avoid penalties.

-

10 Things to Do When Starting Your Retirement Fund

Starting a retirement fund in your 20s or 30s is crucial for long-term financial security. Begin early to maximize compound interest, utilize employer matches, and consider a Roth IRA. Set consistent savings goals, choose low-fee investments, and avoid early withdrawals. Regular check-ins on your accounts ensure steady progress toward a comfortable future.

-

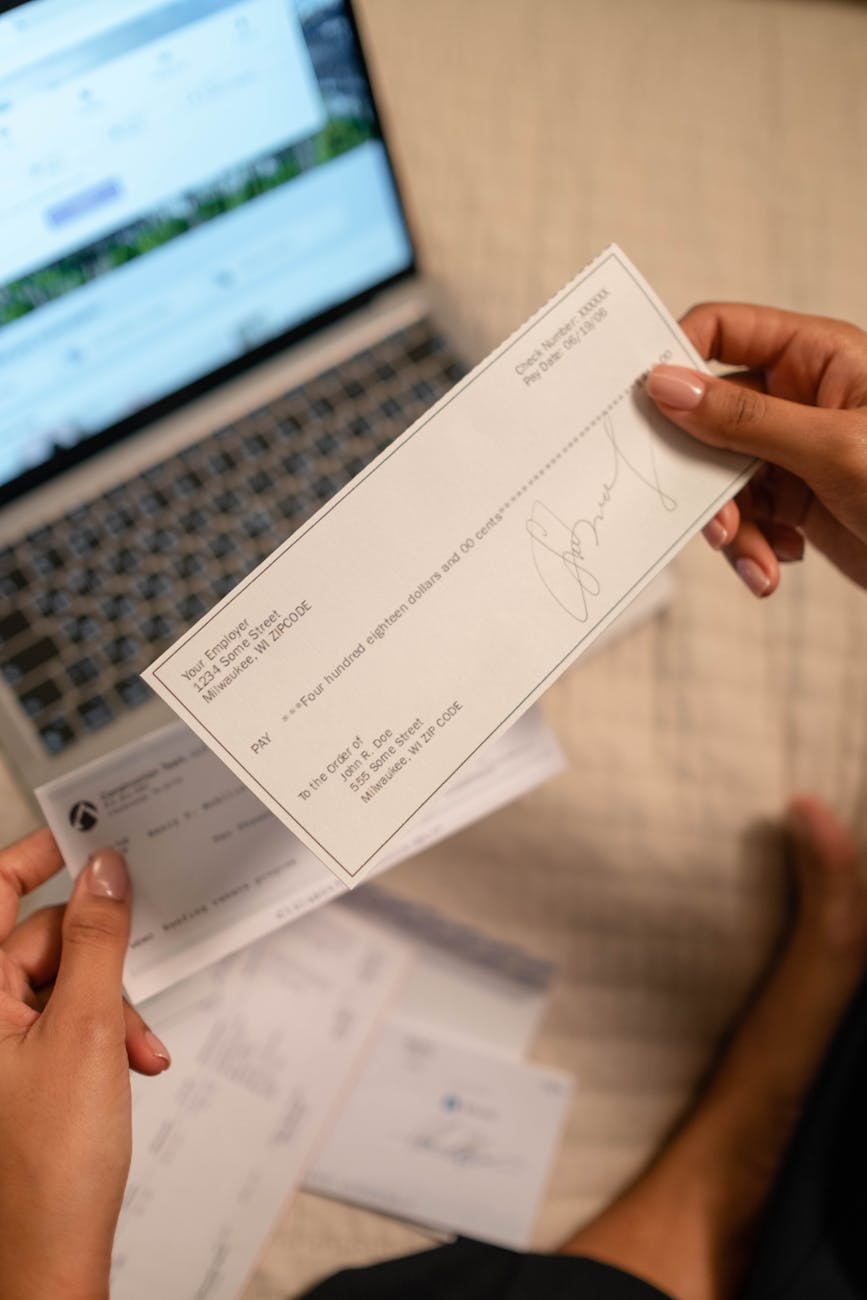

What Exactly Should I Do First When I Get My First Paycheck?

Receiving your first paycheck is an exciting milestone, but knowing how to manage it can be daunting. Begin by understanding your net pay and creating a budget using the 50/30/20 rule. Build an emergency fund, pay off high-interest debt, save for long-term goals, and remember to budget for enjoyment. Taking these steps fosters financial confidence.

-

Your Simple Guide to Start Investing Wisely

Investing isn’t just for the rich or pros; anyone can do it! You can start with as little as $5 and grow your wealth over time, thanks to compound interest. Avoid common myths, set clear goals, and diversify. Just stay consistent, and watch your money grow. Ready? Dive in!

-

A Simple Guide to Emergency Savings

Life can throw unexpected challenges your way, so having an emergency fund is crucial. It’s your financial cushion for surprises like job loss or medical bills. Aim for 3-6 months of expenses, depending on your stability. Start small, automate savings, and adjust as life changes. Build that peace of mind!

-

A Simple Guide to Retirement Funds: Common Types, Pros and Cons, and How to Get Started

Saving for retirement is crucial for financial security in older age. There are various types of funds like 401(k)s, IRAs, and pensions, each with pros and cons. Start by assessing your finances, contributing as much as possible, diversifying investments, and avoiding common mistakes like cashing out early.